After a gloomy 2022, the global economy appeared to be in slightly better shape by the end of the year. What does 2023 hold in store for business and economic prospects for the East African region? In our commentary we lay out some views about how the year might unfold.

ECONOMIC OUTLOOK

This commentary is based on the IMF’s World Economic Outlook, January 2023.

Introduction – a look back at 2022

2022 was supposed to be the year in which the global economy made a recovery from two years of virtual lockdown because of Covid-19; but then along came the Russia-Ukraine conflict, a significant increase in Covid cases in China, cost of living issues globally bringing about increased poverty, drought that is creating famine and the continued impact of Climate Change. In fact, the first half of the 2020s have actually seen most of the world go backwards.

As the World Economic Forum (WEF) Global Risks Report 2023 points out: “As 2023 begins, the world is facing a set of risks that feel both wholly new and eerily familiar” but yet “few of this generation’s business leaders and public policy-makers have experienced”. The WEF report, summarising their survey, predicts that the short-term (2 years) will be dominated by the cost of living and the long-term (10 years) by Climate Change. Global trade wars and cyber risk and crime also feature over the longer horizon.

|

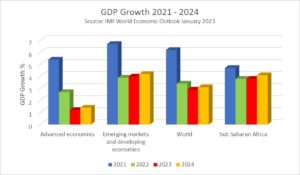

“Global growth is projected to fall from an estimated 3.4 percent in 2022 to 2.9 percent in 2023, then rise to 3.1 percent in 2024”. IMF World Economic Outlook January 2023 |

The IMF in their January 2023 World Economic Outlook similarly pointed to inflation, the Russia-Ukraine crisis and the resurgence of Covid-19 in China as the main factors that slowed the rate of recovery in 2022. Of these three, the 2023 Outlook sees the first two as playing a significant role in global economies in 2023.

The World Bank has an even more pessimistic outlook for 2023 projecting growth to slow to 1.7%. Indeed, they believe that “any new adverse development” would mean the possibility of a global recession, which as they point out “would be the first time in more than 80 years that two global recessions have occurred within the same decade”. Quite a sobering thought!

A look forward: GDP growth

Despite a gloomy and somewhat slow first 6 months of 2022, the IMF Outlook points out that most economies saw what they term a “surprisingly strong” growth in GDP in the third quarter largely driven by domestic consumption, spending and investment. This could well be the effect of two years of lockdown and pent up demand coming to the fore. However, this was an aberration as the fourth quarter saw growth slow in most major economies. China, is one major economy, that slowed significantly in 2022, but prospects are a little brighter for 2023.

Attempts to curb inflationary pressure seem to be working in most parts of the world, but there is a long way to go and the full effect may not be evident till 2024. The lower growth projected for 2023 as compared to 2022 by the IMF, is a function of the battle against inflation with interest rates being rapidly hiked.

Interestingly, it is only advanced economies that are expected to show lower growth in 2023 than 2022. Emerging Markets and developing economies are expect to show higher growth, albeit marginally. Indeed, those markets are expected to account for nearly 80% of global growth with India providing 15% of this! Sub Saharan Africa will remain largely flat between 2022 and 2023.

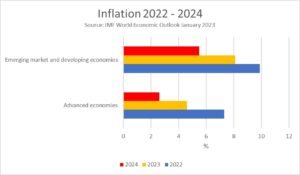

A look forward: Inflation

During 2022, the world saw significant hikes in interest rates by Central Banks in a bid to curb the inflation menace. By all accounts this strategy has started to pay off and, when coupled with falling energy prices, there is a sense of optimism that runaway inflation is easing.

|

“However, upside risks to the inflation outlook remain. Despite the recent moderation in headline inflation, core inflation remains stubbornly high across most regions, labour markets are still tight, energy prices remain pressured by Russia’s ongoing war in Ukraine, and supply chain disruptions may reappear. To keep these risks in check, financial conditions will likely need to tighten further. If not, central banks may need to increase policy rates even more in order to achieve their inflation objectives”. IMF World Economic Outlook January 2023 |

However, the effect of these interest rate hikes on the world’s low-income countries may not be that welcome. The IMF estimates that 15% of these countries are facing debt distress and up to 45% are at high risk. The strengthening US Dollar and the Federal Reserve rate hikes, has meant that a number of countries have seen capital flight and as many are import reliant, a widening trade deficit.

The projection by the IMF is that there will be a fall in inflation between 2022 and 2023.

Upside risks

According to the IMF, an upside risk for 2023 is a possible boost in domestic spending globally as was witnessed in the third quarter of 2022. This could come about as savings rate in the advanced economies are higher than expected in all likelihood because of reduced spending during the pandemic. One significant upside of this for the Eastern Africa region could be a boost in tourism earnings as the travel bug continues – two years of non-travel will give this a boost. While tourism numbers may not rise in terms of arrivals, tourism earnings could get a boost.

Inflation could fall more rapidly than expected with the associated relaxing of interest rates. This is likely to be good news all round.

Downside risks

The bad news is that the downside risks probably outweigh the upside!

China, which towards the end of 2022 showed signs of recovery, still has to deal with Covid-19 with the failure of its zero Covid policy. Its real estate sector continues to be shaky which could impact its financial sector. The impact of China’s failed zero Covid policy, with lack of goods and supply chain disruptions, could impact the rest of the world.

The Russia-Ukraine crisis, which started a little over a year ago, and shows no sign of abating, remains a significant downside risk. While Europe has coped with this winter through alternative supplies of energy, if the conflict goes on for the rest of 2023, this may not be so simple in the future. Food prices will also continue to be vulnerable if the conflict continues.

Debt distress in the low-income countries (see above) is also a significant downside risk.

While inflation appears to have peaked, it remains a significant risk going into 2023 and possibly 2024.

And finally, global geo-political risks remain, not only with the current European conflict but the China threat, both in terms of trade wars and the Taiwan issue which could come to the fore.

What are the priorities

The key priorities for 2023 and the future according to the IMF are:

- Securing global disinflation

- Containing the re-emergence of Covid-19

- Ensuring financial stability

- Restoring debt sustainability

- Supporting the vulnerable

- Reinforcing supply

- Strengthening multilateral cooperation

Both good and bad news

After two years of the pandemic, the world was ready for some good news and it was nice to see an upturn, albeit, not as much as needed in global economies. The conflict in Europe rather destroyed the sense of optimism there was in early 2022. However, people were fed up and decided to start leading a normal life which is expected to continue into 2023.

The bad news is that, the conflict continues, Covid has not fully disappeared and climate related disasters are becoming more common.

But human kind is nothing if not resilient and optimistic. With some luck and a prevailing wind, the next two years will see the world bouncing back!